Isle of Man is one of the most sought destination by foreign investors interested in establishing offshore companies because of the trading facilities they can benefit from in the European Union. Setting up a company in the Isle of Man is subject to several requirements which fall under the governance of the Companies Law.

Among the requisites for opening any type of company in Isle of Man in 2024, the legal address and the bank account opening is mandatory. Below, our company formation agents in Isle of Man explain the procedure for opening bank accounts here.

Table of Contents

Types of bank accounts in Isle of Man

The banking system in the Isle of Man is based on the UK system. Also, most of the financial institutions operating here are branches of UK banks which gives a high level of confidence to those who want to set up various types of bank accounts.

Among the types of accounts that can be opened with Isle of Man banks are:

- personal bank accounts;

- savings accounts;

- corporate bank accounts.

One of the most popular type of account sought by foreigners is the non-resident Isle of Man bank account.

| Quick Facts | |

|---|---|

| Mandatory local bank account for companies (Yes/No) |

Yes |

|

Mandatory residence requirement |

No |

|

Bank account opening time |

1 or 2 days are needed to open a bank account in the Isle of Man and around 7 days to receive the card |

| Online bank account opening |

Yes |

| Bank accounts for foreign nationals in Isle of Man | Yes |

| Required documents – companies |

Valid identification documents for the business owner |

| Required documents – individuals in the Isle of Man |

Valid identification document, proof of residence in the Isle of Man, proof of address, other documents such as an employment contract |

| Special requirements for foreign nationals who open a bank account in Isle of Man | Proof of lawful residence in Isle of Man |

| Bank fees | Monthly account fees can include £18 for personal premium accounts |

| Initial deposit | Not usually. Some banks offer the option to open an account with as little as £1 |

| Types of accounts in the Isle of Man | Current accounts (various options as per chosen bank), savings accounts |

| Online banking | Yes |

| Local agent requirements | Not mandatory but advisable |

| Main banks in Isle of Man | Conister Bank, Isle of Man Bank, Lloyds Bank International Limited, Barclays Bank and others |

| Criteria for choosing the bank when you open a bank account in Isle of Man | Monthly account management costs, branch and ATM distribution within the Isle of Man, online banking and mobile app options, familiarity with a certain bank, etc. |

| Age requirement to open a bank account in Isle of Man |

18+ years |

|

Due diligence |

Some banks might conduct due diligence procedures when opening new accounts or engaging in financial transactions with clients. |

|

Types of personal bank accounts |

– everyday accounts, – special benefit accounts (gold accounts), – plus accounts, – student accounts, – accounts for foundations, etc. |

| Account closure |

Personal bank accounts can be terminated at any time, but certain fees or charges for closure may apply. |

| Transaction limits |

– daily withdrawal limit, – overseas transfer limit, – daily spending limit, etc. |

| Transfer processing times |

Generally, for two accounts of the same bank, transfers are done on the same day. |

| Switching to another bank |

Our team can facilitate the process of transitioning to another bank. |

| Interest rates |

Depends on the bank, account type and other economical factors. |

| Required for offshore Isle of Man company formation (YES/NO) |

YES |

| Exchange agreements | Some international agreements require banks in the Isle of Man to share information about your money with tax authorities in your home country or the country where you pay taxes. |

| Regulatory institutions regarding banking in Isle of Man |

Isle of Man Financial Services Authority |

| Other banking services in Isle of Man |

– loans, – insurance, – wealth management, – pensions etc. |

| ATM fees |

– withdrawal fee, – currency conversion fee, etc. |

| Benefits of opening a bank account in Isle of Man |

– fast process, – advantageous for non-UK residents who cannot open an account in UK, – cost-friendly service, – access to UK banks, etc. |

| Assistance |

Our team can help you open a bank account when you open a company in Isle of Man or other circumstances. |

International clients and expats who wish to open a remote bank account in a stable, first-world country with good financial services one of the categories of clients who can benefit from opening an Isle of Man bank account. Non-UK residents working abroad who are not able to open a bank account in England (for various reasons that can be further discussed with our agents) can open a bank account in the Isle of Man and thus access a UK branch present in this location. In fact, opening a bank account in the Isle of Man compared to the UK can be subject to lower costs, it can be faster and easier – all very good reasons to open for a bank account in a Crown Dependency such as the Isle of Man.

Followed by non-residents and foreign individuals interested in offshore banking options with good access to UK banks or other international bank branches are local companies incorporated in the Isle of Man. These represent another important percentage of the types of clients interested in Isle of Man banking. Like in the case of non-residents, banking options meet the needs of all types of investors or entrepreneurs who start a company in the Isle. Lastly, high-net worth individuals may also explore the banking options available in the Isle of Man. Our company formation agents can give you more details about each of the banking benefits available to these categories of clients, as well as some of the most suitable banks to chosen, depending on individual needs.

When choosing to open a bank account in Isle of Man for a business, investors should take into consideration a few key aspects:

- the business needs: offshore company formation in Isle of Man is attractive because the company can be used for many business purposes, including offshore activities; these business needs need to be taken into consideration.

- different features: the bank account may provide different features, depending on the account type; these should be taken into consideration and account holders should select those services that are relevant to their business.

- funding: some businesses may require additional funding; this can be discussed with bank representatives and the company founders can prepare for this specific step.

- payment services: especially for international businesses, payment management, and international payments should be covered by adequate banking services; merchant accounts can be opened by businesses that provide e-commerce services.

These are just some of the features investors should pay attention to when opening a bank account in the Isle of Man in 2024. One of our agents who specialize in Isle of Man company registration can provide more details as to the issues that need to be verified before opening the account. These can differ according to the business field in which the company activates (as mentioned above, the merchant account is required in case of e-commerce businesses as well as other types if companies but it is not mandatory for others such as holding companies). While it is not a general rule, banks in the Isle of Man will engage in due diligence procedures that may be more thoroughly performed than in other jurisdictions, particularly to mitigate risk. This means that the bank account opening application will go through an initial evaluation and it may be subject to further due diligence procedures, before the bank will approve the opening of the account. This can also translate into higher fees and higher opening and deposit requirements, also for the purpose of mitigating risk (if the bank evaluates the potential client as a higher risk one). However, this can be avoided when working with our team, as you will receive personalized information depending on your profile.

Our company registration advisors in Isle of Man can help you create any of the bank accounts mentioned above. We also provide professional bank account creation assistance to foreign companies interested in opening an account here. As previously mentioned, policies differ across banks and some may have more stringent requirements for foreign companies, with bank account applications being refused. You can avoid this by discussing with our agents before making the application with a certain bank.

The requirements for non-resident and foreign banks are justified given the Isle of Man’s reputation for stable banking and regulations, the sophistication of many of its financial services and the fact that English is used in this jurisdiction – making it highly attractive for investors, entrepreneurs and foreign nationals around the world.

Our company is part of Bridgewest – an international network of law firms and company formation agencies, so foreign investors who need legal services in other countries, for example in Thailand or assistance for setting up a company in Ukraine, can receive personalized advice from our partners.

Requirements to open an Isle of Man bank account in 2024

The requirements for setting up a bank account with a local bank depend on whether the future client is a natural or legal person. In the case of individuals, an identity card or passport will be required as identification documents.

In the case of companies seeking to have bank accounts with Isle of Man banks, the requirements are different. The following are required to present passports and evidence of a local residential address:

- the shareholders of the company;

- the beneficial owner of the company, if any;

- the director or directors of the company;

- the representative of the company.

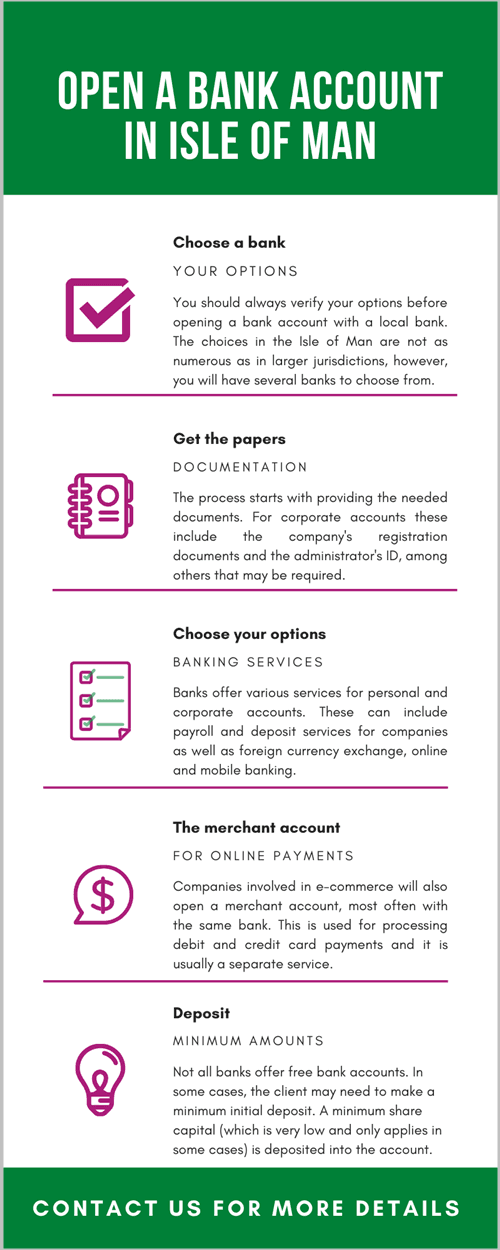

The great advantage of opening a non-resident bank account in Isle of Man is that local banks do not require the physical presence of the applicant. Also, a minimum deposit must be considered depending on the bank. Please see below the main steps to follow in order to open a bank account in Isle of Man:

Switching to a different bank account in the Isle of Man

In some cases, investors who open an Isle of Man company may wish to switch their business account to another bank. This may occur for a variety of reasons, such as improved banking support, more types of services, better options for international payments, a wider range of ATMs or other reasons. If this is a mandatory step, and the company representative or director cannot be present in the Isle of Man during the change, one of our Isle of Man company formation agents can provide the needed support via a power of attorney. You can reach out to us for more details.

Some banks offer services such as a dedicated business manager who will oversee a certain business account. Moreover, the switching process is simplified in the Isle of Man, making it easy for investors who wish to change the bank to do so. Business banking should be one area that helps simplify the overall activities instead of hindering them in any way. This is why company owners can consider changing the bank in 2024 should their business needs required such a step.

Banking in the Isle of Man

Opening a bank account is required for those who are interested in offshore company formation in the Isle of Man. However, it may also be required in the case of individuals. Banks also offer a wide range of personal or individual bank accounts, apart from the business ones.

Entrepreneurs who wish to do banking in the Isle of Man can choose between several types of bank accounts. Everyday bank accounts, those with special benefits (gold accounts) or plus accounts are available. Some banks will also offer student accounts or accounts for foundations (one that has no overdraft facility and no checkbook).

Personal bank accounts in the Isle of Man may be terminated at any time, however, certain fees or charges for closure may apply. When this takes place, any unused cheques or cards, as well as tokens for online payments, must be returned. The terms for the account closure are laid out in the services agreement signed with the bank when first opening the account.

For information on how to terminate a business bank account, as well as submitting complaints with the bank and handling certain types of disputes in relation to business purposes or transactions, please feel free to reach out to our Isle of Man company formation agents.

An important issue to outline concerning banking in the Isle of Man in 2024 has to do with banking secrecy. Individuals who open a bank account here should be aware that the Common Reporting Standards (CRS), the Foreign Account Tax Compliance Act (FATCA) and the Automatic Exchange of Information (AEOI) apply. The Isle of Man also has an Intergovernmental Agreement with the United Kingdom and an alternative reporting regime (ARR). The implementation of these international agreements means that Isle of Man banks can, and in some cases will be required to, report financial assets to the tax authorities in the account holder’s country or origin (or the tax residency country). Hundreds of countries across the globe are signatory states to these agreements, meaning that there is a high change that the bank account holder’s country will ne a committed jurisdiction to one of the treaties. For example, in September 2020 there were 106 countries committed to the Common Reporting Standards, including but not limited to the British Virgin Islands, China, Saudi Arabia, Singapore, Seychelles, and many more (the list also includes 45 developing countries). Our team can give you complete details on the list of countries that have signed exchange agreements with the Isle of Man.

Our agents invite you to watch the following video on how to open a bank account in Isle of Man:

Isle of Man banking statistics

Opening a bank account in Isle of Man is only one of the required steps for investors who start a business here. Additional ones can include obtaining special permits and licenses, for example from the Isle of Man Financial Services Authority. This particular license only applies to businesses that offer certain types of services. Interested investors can find out more information from our agents.

The Isle of Man offers a number of business benefits, from easy and fast company formation to convenient banking options as well as a generally attractive business regime.

According to data concerning the banking statistical bulletin, the report issued in March 2023 shows the following:

- Total deposits in Q1 2023 amounted to £42.4 billion;

- There were 11 banks in the third quarter of 2023 and they employed 1,971 individuals; the number of banks has remained unchanged since December 2020; previously, there were 12 banks in the Isle of Man (from December 2019 through June 2020);

- The retain deposits in March 2023 amounted to 22,888 million £, and the total deposits had a value of 42,391 million £;

- The country of origin for most banking groups that operate in the Isle of Man is the United Kingdom, followed by Spain.

In the case of corporate bank account openings, our company formation consultants in Isle of Man can represent you.

This small island in the Irish Sea, a Crown Dependency, has proven itself as an important financial hub and offshore location. While other offshore locations many be subject to blacklisting, the Isle of Man is a stable location for bank account opening, company formation and accessing the wide array of financial services locally provided here.

Once you set up a company, we can also give you details about Isle of Man residency by investment.

Our team can give you more details about company formation principles, rules and regulations in this jurisdiction. Do not hesitate to contact us if you need assistance in order to open a bank account in Isle of Man and starting a business in this jurisdiction.