A ready-made company or a shelf company is a legal entity that has been registered as per the local laws but has yet to commence any business activities.

Investors who buy a shelf company in the Isle of Man benefit from a speedier incorporation process and an important advantage is that they can begin the business activities in less time than they would in case of a newly incorporated company.

Our Isle of Man company formation agents can give you complete information about the advantages of a ready-made company and can help you with a complete shelf company package. If you need assistance for opening a shelf company in another country, for example in Brazil, please get in touch with our partners – CompanyFormationBrazil.com.

| Quick Facts | |

|---|---|

| Legal entities available for shelf company |

Company limited by shares Company limited by gurantee Company limited by gurantee with a share capital Unlimited company with a share capital Public Company |

| Time required for purchasing the company | Approximately 1-5 days |

| Types of features it includes | Isle of Man bank account as part of the additional services |

| The advantages of a shelf company |

Good business image through longevity Good business credit Easy purchase and set-up Credibility for both clients and business partners |

| Appointing new directors | Yes |

| Capital increase allowed | Yes |

| Certificate of no commercial activities | Yes. Optional Certificate of Good Standing |

| Modify the objects of activity | Yes |

| Participants in the purchase procedure | The buyer (real or natural person) and the seller (usually an Isle of Man based corporation). |

| The cost of buying a shelf company | Starting at £3,000/€3,500 depending on features |

| Who can buy shelf companies? |

Both local residents and foreign investors. We can assist them in the Isle of man company formation procedure. |

|

Documents needed to buy shelf companies |

– ID documents, – power of attorney (if applicable), – statutory documents of the shelf company, – details about the new company, etc. |

|

Associated risks with purchase (YES/NO) |

No, there are no debts or liabilities associated with shelf companies. |

| Physical presence required (YES/NO) |

No, our agents can buy shelf companies and open a company in Isle of Man remotely. |

| Virtual office available (YES/NO) |

YES |

| VAT registration |

Might be necessary for some companies. |

| Special permits and licenses |

Depending on industry, some shelf companies might require them. |

| Corporate income rate |

0% (standard) |

| Offshore shelf companies (YES/NO) |

YES |

| Shelf company vs. newly opened company |

A shelf company is a pre-registered entity available for immediate purchase, while a newly opened company involves the formation process from scratch, requiring time and administrative procedures. |

| Due diligence characteristics |

– verifying trading activities, – examining contracts, – addressing potential legal matters, etc. |

| Process of purchasing shelf company |

– selecting shelf company, – conduct due diligence, – prepare documents, – transfer ownership, – comply with relevant authorities, etc. |

| Common industries for shelf companies |

– IT, – financial, – e-commerce, – advertising agencies, – consultancy, etc. |

| Additional services |

Once you open a company, we can help you with tax-related matters through our partner accountants in the Isle of Man. |

| Assistance (YES/NO) |

YES, we provide full assistance when opening a shelf company. |

Table of Contents

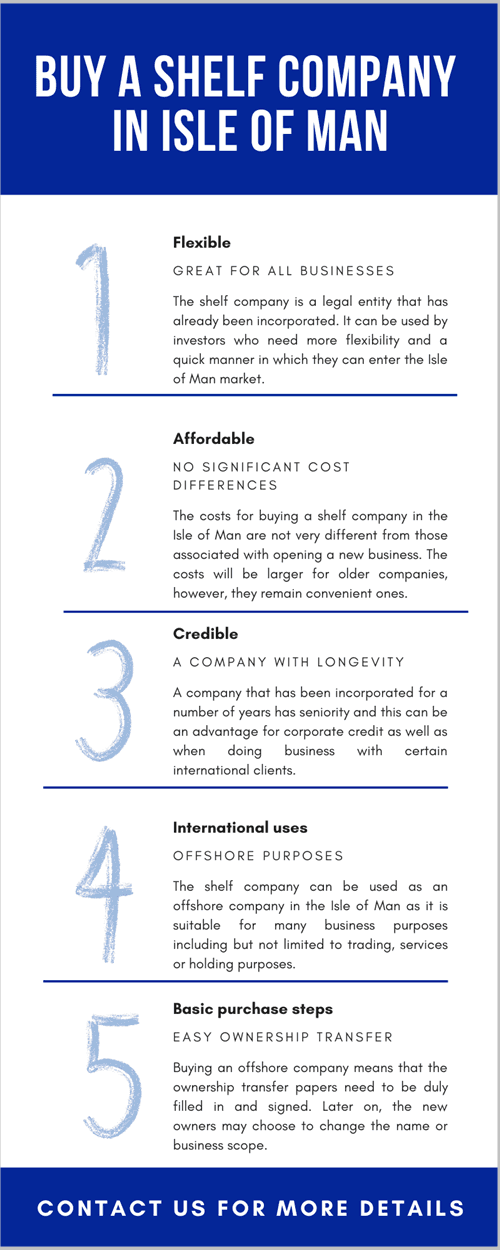

The benefits of buying an Isle of Man shelf company

The main benefits of buying a shelf company in the Isle of Man are listed below:

- duly incorporated: The company has been incorporated as per the Island of Man requirements but has not entered into any commercial activities, thus it has been `left on the shelf.

- no bad credit: a shelf company is an incorporated legal entity with no assets and liability and with no bad credit history.

- time-saving: buying a shelf company saves the time needed to incorporate and can offer an even higher degree of anonymity.

- credible: the fact that the company has an older incorporation date can prove to be advantageous for certain business partnerships as it can offer credibility; moreover, an aged company can have better chances of obtaining bank loans and credits, compared to a start-up or newly incorporated company.

Investors should note that not all shelf company packages or options contain a bank account for the company. This can be a subsequent step, once the transfer has been handled. One of our Isle of Man company formation agents can help assist during this stage.

If you need assistance in starting a business in another country, for example in Finland, we recommend our partners – LawyersFinland.com.

The use of an offshore company in the Isle of Man

The longevity of the company, as well as the advantage of being able to use a particular business name that is already registered, are two of the most important advantages of choosing to purchase a shelf company in the Isle of Man. While it is true that the company is ready to use as soon as the transfer documents are complete, the fast Isle of Man company formation process does not make the time-saving criteria as important as in other jurisdictions. This is why investors who do choose to buy a ready-made company will do so primarily because they need the credibility of a company that has been incorporated for some time. This can be particularly important in situations in which the company will be involved in international trade and the future business partners appreciate an aged company, with good credit history and no bad debts.

Choosing to buy a company with an already approved name may be a strong motivator to purchase a company instead of opening a new one. Some ready-made companies are sold in an incipient phase, meaning that only their names have been approved and registered and the rest of the steps need to be handled in order for the company to be duly registered. This can be important when investors find a company with a particular name. In this case, the value of the Isle of Man shelf company lies solely in its registered name. Do you want to open a company in another country, such as Bahrain? We can put you in contact with our partners.

Offshore companies for sale in the Isle of Man

The purchase of a used or aged company should not be a procedure performed without a proper company due diligence. This is recommended to all investors in order to avoid unnecessary risks.

The Isle of Man corporate regime is a particular one because of the fact that there are two separate company law regimes: the 1931 Act which is based on a more traditional company law regime and the 2006 Act, based on the models already existing in other offshore jurisdictions, that follows the international business company regime. Regardless of the type of corporate law, investors in the Isle of Man can choose between several forms of companies:

- the company limited by shares;

- the company limited by guarantee;

the company limited by shares and guarantee;

unlimited companies;

It is important to note that the incorporation of 2006 Act companies is subject to certain requirements: this is accomplished by a licensed Isle of Man registered agent. There are different requirements, according to the regime after which the company is incorporated. For example, the 2006 Act company is required o have a licensed registered agent while the 1931 Act companies must have a company secretary. These details, along with others concerning the constitutive documents of the companies, are relevant when buying a ready-made company.

The offshore shelf company package offered by our Isle of Man company registration agents includes a registered company that has its Certificate of Incorporation, Memorandum, and Articles of Association. Most of the pre-formed companies provided by our team of agents are business entities that follow the 2006 mode. This means that the business structure has one director and one shareholder. An additional service can be requested by those investors who need registered agent services. For many of these ready-made companies, a minimum number of additional steps will be needed for the transfer of ownership once investors decide to acquire an already existing one.

Once the buyer finalizes the purchase process, he will also need to be mindful of the applicable accounting principles (IFRS, or UK GAAP in most cases), as well as the requirement to file the annual return. While the shelf company will generally be subject to the o% corporate income tax regime, working with a CPA in the Isle of Man will ensure that it properly maintains its needed records.

Buying a shelf company can be a first step towards investing and obtaining Isle of Man citizenship by investment.

Our experts present a short video on the main features of the shelf company:

Shelf company due diligence

An essential process for many investors who purchase a shelf company in the Isle of Man is the due diligence phase. Essentially, this is a thorough verification of the company’s history in order to determine if the details offered upon purchase are the true ones and if the company has any undisclosed debts. It is important to perform this before signing the purchase agreement and one of our Isle of Man company registration agents can assist you.

The key aspects of the due diligence phase are the following:

- Trading activities: ideally, a shelf company for purchase has never been used for any trading activities; this is essentially a new business that has only been registered.

- Debts: a shelf company should not have any debts towards third parties; this is a favorable consequence of not having been involved in trading activities.

- Contracts: verify any contracts, if any, that may have been signed with other companies, distributors or clients.

- Legal matters: the due diligence verification should also include a report issued by an attorney clearing the business of any potential future claims against the company.

Please keep in mind that this list is not an exhaustive one and different issues should be verified as per the type of company that is being purchased.

When you purchase a shelf company via our Isle of Man company formation agents, you can rest assured that the company has no debts and that the corporate details and features are accurate.

Because the Isle of Man is perceived as an offshore center, effective due diligence is required in order to make sure that a shelf company is financially transparent and that the business has not been subject to any suspicious activities. This verification is essential in order to make sure that purchase is a risk-free one and that the new company owners will be able to use the business without any problems. Some of the risks that may be associated with purchasing shelf companies from unverified sources can include a bad credit history for that company as well as the company having been used for money laundering purposes in the past.

If you want to buy a shelf company after moving to the Isle of Man, we can assist you.

Isle of Man company formation

The Isle of Man is a location that offers a number of advantages, including but not limited to a good business climate, complete with top credit rankings, as well as a zero-percent corporate income tax rate for most of the business activities in which businesses typically engage on the Isle. The location is also an important advantage: investors have access to an offshore company regime (because of the zero tax) very close to major EU countries. for customs, excise and VAT purposes, the Isle of Man is considered part of the EU but it is not considered part of the Union for all other taxes. Being able to minimize the overall corporate taxation is an important reason why investors choose to base their company here. Buying a ready-made or shelf company is the quickest process through which investors can get started here.

According to the Isle of Man Government, the following statistics apply to the number of companies opened as per the two different types of Companies Act mentioned below:

- 15,967: total 1931 Act Companies at the end of December 2019;

- 9,577: total 2006 Act companies on 31/12/2019;

- 16,249: number of 1931 Act Companies on 31.03.2019;

- 9,543: number of 2006 Act Companies at the end of March 2019.

For the purpose of interpreting the result of the statistics, it is useful to point out that this is a cumulative total and that companies that are incorporated in other jurisdictions that choose to establish a place of business in the Isle of Man are required to register under the 1931 Companies Act.

Investors who are interested in offshore company formation in the Isle of Man can contact us for detailed information about company registration, bank account requirements and the advantages of running an international business from this location.