Investors who set up a trust in the Isle of Man benefit from a favorable regulatory environment that combines both a welcoming business regime for investors and highly rated financial supervision policies.

The Isle of Man offers a wide range of investment vehicles, not only trusts but also funds and open-end investment companies. Our team of Isle of man company formation agents can help you with detailed information about any of these legal forms.

Table of Contents

Trusts in the Isle of Man

A trust in the Isle of Man will provide trustee services to investors, both for commercial and for personal purposes. Examples of uses for a typical trust include:

- wealth protection and preservation for families;

- succession planning both for businesses and individuals;

- asset protection;

- tax reduction;

- pensions;

- employee benefit schemes.

| Quick Facts | |

|---|---|

| Why set up a trust |

– wealth or asset protection, – succession planning, – charitable purposes, – tax planning, – medical planning, – educational funding, etc. |

|

Discretionary trusts |

Trustees have full discretion to distribute the trust’s capital as specified in the trust deed. |

|

Life interest trusts |

Beneficiaries receive a predetermined share, with possible access to capital after the trustor’s death. |

| Purpose trusts | Non-charitable, with a minimum of two trustees, often used for asset financing, securitization, or holding shares in a private trust company. |

| Charitable trusts |

Created for charitable purposes like poverty relief, education, religious causes, or community benefits. |

| Pension and employee benefit trusts |

Used to manage pension funds or provide incentives to employees. |

| Laws governing trusts in Isle of Man |

Trusts (Amendment) Act 2015 |

| Trustee duties |

– adhering to the trust terms, – act in good faith for the purposes for which they were appointed, – provide information to beneficiaries, follow specific investment criteria, etc. |

| Accountability of trustees |

If a trustee breaches their duty of care, they can be held accountable by the beneficiaries. |

| Taxes extemption |

– capital gains tax, – inheritance tax, – gift tax, – estate tax. |

| Income tax |

– 20% (for residents); Our accountants in Isle of Man can offer guidance regarding income tax. |

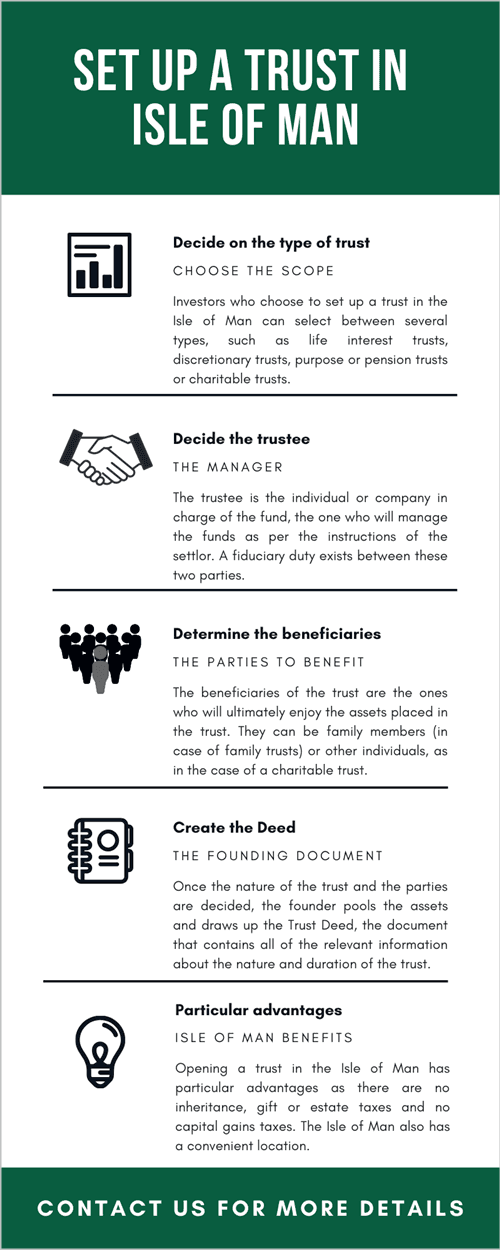

| Process of opening a trust |

– decide the trust type, – appoint the trustee, – determine the beneficiaries, – create the Trust Deed. |

| Private trust companies – characteristics |

Their primary function is acting as a trustee; Can hold both personal and business assets within the trusts; The settlor maintains control over the trust and its management. |

| Advantages of opening a trust in Isle of Man |

– tax benefits, – asset protection, – wealth management, – confidentiality and security, – flexibility, – international asset management, etc. |

| Assistance | We can help you open a trust or a company in Isle of Man, as well as in other legal matters. |

The types of trusts most commonly employed in the Island of man include the following, briefly described in the list below:

- discretionary trusts: this is a common type of trust used in the Isle of Man in which the trustees have full powers for deciding now to distribute the capital and decide the amount received by the beneficiaries; these powers are awarded through the trust deed.

- life interest trusts: one of more beneficiaries receive a pre-determined share for a specified period of time; the beneficiaries can have access to the capital after the death of the trustor.

- purpose trusts: these are for non-charitable purposes and must have at least two trustees; they can be used for asset financing, securitization or to hold shares in a private trust company.

- charitable trusts: can be used for various charitable purposes such as poverty relief, education, religious purposes or other purposes that would benefit the community;

- pension trusts and employee benefit trusts: these can be used either to house pension funds or to motivate employees.

A trust arrangement offers a high degree of flexibility for investors and also a convenient level of security. What’s more, the arrangements between the trustor and the trustee are confidential and are not included in public records. One of our Isle of Man company registration agents can give you complete information about the available professional trustee.

The Trusts Act

The Trusts (Amendment) Act 2015 was enforced in order to provide changes to the Trustee Act 1961 that made it mandatory for trust corporations to have two individuals who will act as trustees in certain cases. The Amendment also brought forth a number of other changes, such as the vesting within a perpetuity period or the manner in which certain foreign law exclusions concerning trusts were governed by the law of the Isle of Man.

The Act made it so it will not be compulsory to appoint more than one trustee, in those cases in which only one was appointed initially. Also, it is not mandatory to fill up a number of trustees. Also, the rule against perpetuities for future dispositions was abolished.

No judgement or court order issued outside the Isle of Man is recognized or enforced when it is inconsistent with the Act, or when the High Court orders so, for the purpose of protecting the interests of the beneficiaries or for the purpose of allowing for the proper administration of the trust. This has affect irrespective of other statutory provision or rule of law that refers to the enforcement of judgments.

All issues concerning trusts in the Isle of Man are to be settled according to the local law, without resorting to references to laws applicable in other jurisdictions.

The Isle of Man trust laws protect trust owners, to a certain degree, from forced heirship or rights that may arise through marriage/former marriage. Nonetheless, investors are advised to seek proper counsel on the applicable laws, especially when the assets placed in the trust are located in a foreign territory.

Our team specializing in the Isle of Man trust law can give you more details about the laws in force and the provisions for the enforcement of foreign judgments. You are also invited to contact us if you need advice on how to set up a bank account for a local entity.

Trustee services in the Island of Man

Investors who open a trust in the Isle of Man will offer their services through an Isle of Man based corporate trustee. The relationship between the trustor and the trustee is a fiduciary one, with the trustee having a number of duties, including exercising reasonable care, acting in the best interest of the trustor or to act fairly and impartially. The main duties of a trustee include the following:

- know and observe the terms of the trust (an exemption applies when this action is directed by a court);

- protect the trust property and separate it from their own assets or those included in other trusts;

- act in good faith and only for the purposes for which they were designated;

- provide information to the beneficiaries when they request so;

- follow certain investment criteria when making trust investments.

Trustees can be held accountable by the beneficiaries when a breach of the duty of care arises.

A trust in the Isle of Man presents an important advantage: it is completely exempt from taxes such as the capital gains tax, the inheritance, gift or estate tax. A trustee can be a taxpayer and may need to file tax returns, especially when he is a resident of the Isle of Man. Likewise, trust beneficiaries can be liable for taxes if they are residents or of the income arises in the Isle of Man.

Private trust companies

Trust companies are popular in the Isle of Man and they are incorporated for the sole purpose of offering trustee services.

The company is incorporated for the purpose of acting as a trustee and it can hold both personal and business assets. Commonly, the settlor is the one who will incorporate the trust company and will use it for asset protection and management purposes.

The private trust company allows the settlor to remain in control of the trust. This also means that the company can remain under family control, where an option is to include members of the family or trusted financial advisers in the company’s board of directors. Structuring the management of the company is an essential step and careful consideration is needed, especially when appointing persons who will then have the right to appoint or remove directors. When the company is structured in this fashion, the founder will likely benefit from the fact that he will be able to avoid future changes of trusteeship. These services will be provided as an agreement between the private trust company and the company that offers the management services (a regulated services provider). The family will have a higher degree of flexibility when using a private trust company for asset protection services compared to a traditional trust structure.

When using a private trust company, one makes sure that the professional trustee corporate services provider is well aware of the laws in force, the liabilities that arise with this rule and his risks. This means that the professional trustee will take all and any needed steps to allow for a great degree of risk prevention.

The private trust company is not subject to licensing or registration and it can be a cost-effective and straightforward method of controlling assets. The company remains exempt from usual licensing requirements as long as it is not acts as an undertaking trust business.

Using a private trust company can be an alternative to selecting the services offered by an institutional trustee. One of our Isle of Man company formation agents can give you more details about these companies.

Isle of Man financial services providers statistics

Financial services providers are licensed by the Financial Services Authority, in compliance with the ongoing rules and regulations for specific sectors. Some companies hold more than one type of license. Some of the statistics that for the first half of 2021 are the following:

- 95 trust services (Class 5) license holders;

- 39 investment business (Class 2) license holders;

- 124 corporate services license holders (Class 4);

- 8 Class 7 license holders, for services related to management or administration.

The Isle of Man authorities publish regular statistics and these are useful for determining the various activity levels in given sectors of the financial industry. According to the same source, the number of trusts in the Isle of Man has varied over the years, from 19,567 in 2012/2013 to 18,372 in 2014/2015 or 16,531 in 2017/2018. The number of private trust companies was lower compared to the total number of trusts in each of the aforementioned years (for example, there were 227 private trust companies in 2017/2018).

The Isle of Man has a reputation as an offshore and trust center located conveniently close to important markets in the European Union. The establishment and the administration of trusts can be performed with the help of our local specialists and we do recommend seeking specialized assistance according to the type of trust you intend to set up.

For more information on offshore company formation in the Isle of Man, the process of opening trusts or funds, and other investment advice, please do not hesitate to contact us.

Our team can also provide investors with accounting and tax compliance solutions. A CPA in the Isle of Man from our team offers bookkeeping services, assistance in preparing the annual return, tax payments (only for companies that are subject to the corporate income tax), as well as social security contributions management, and other specialized accounting solutions.